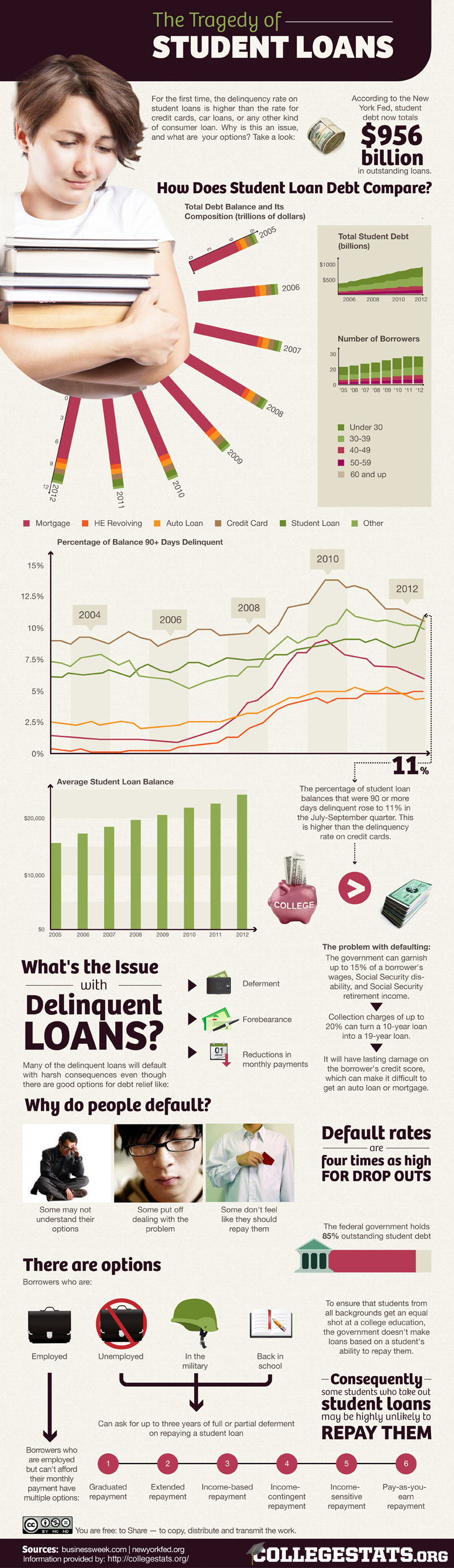

For the first time in the history of the United States, the delinquency rate on student loans is higher than the rate of all other consumer loans, including credit and car loans. According to the latest data from the New York Federal Reserve, total student loan debt stands at $956 billion.

A new infographic from CollegeStats.org puts the U.S. student loan dilemma into perspective.

Economic Collapse News first reported in late November that the student loan bubble was collapsing due to the delinquency rate transpiring. The Fed’s Quarterly Report on Household Debt and Credit showed a “red flag” and that there was a growing problem because 11 percent of student loans were 90 days or more past due. The infographic showed that the delinquency rate rose by about five percent since 2005.

Most borrowers are under the age of 30, but for the past eight years, the number of Americans over the age of 30 attending school has been steadily rising (the research did not show the demographics of student loan debt or the default rate).

Since 2005, student loan debt has been exceeding credit card, auto loan and other consumer debt. The average student loan balance (2012) has surpassed the $20,000 mark, but with the delinquency rate rising there are ramifications for the borrowers: the federal government can garnish up to 15 percent of an individual’s income and Social Security disability and retirement income, collection charges of up to 20 percent can add an additional nine years to a 10-year loan and it will hurt the borrower’s credit score.

Many may not understand the terms of the student loan, while others delay handling the issue and even may feel as if they don’t have to pay the money back. However, there are various options, according to the infographic, including if you’re unemployed, back in school or in the military then you can ask for up to three years of full or partial deferment on paying back the student loans.

Furthermore, an employed person can seek different options: pay-as-you-earn repayment, graduated repayment, income-based repayment, extended repayment, income-sensitive repayment and income-contingent repayment.

(The full infographic can be seen at the bottom of this article.)

A new survey by Financial Fit showed that 25 percent of parents say they have not factored college affordability into their search for getting their child into a college or university. The study also found that 46 percent are unsure how much debt their child is willing to take on and more than one-third are unsure how much debt they are willing to commit to.

An overwhelming majority of respondents said they would be willing to sell a car, get a second job or increase their debt so their child can attend a post-secondary institution, even though the enormous tuition rate is too expensive.

“Families are told ‘don’t look at the sticker price—it’s not real,’ and they believe it because it’s true,” said Frank Palmasani , a veteran guidance counselor and former college admissions director, creator of the Financial Fit™ program, in a press release. “But that doesn’t necessarily mean that a school is going to be affordable. Under a blanket of false security, students spend junior and early senior year selecting colleges, testing, and applying, all the while falling more and more in love with their top pick, which may well be unaffordable.”

Early last year, Moody’s economist Cristian deRitis warned that student loan debt defaults could lead to a wave of credit downgrades in the future across the country and this could hurt households from accessing credit for things like a home or an automobile.

The rising cost of tuition has been largely blamed on the federal and state governments because they subsidize student loans. This has allowed educational institutions from exorbitantly increasing tuition costs because students have access to such large sums of money from the taxpayers.

Vice President Joe Biden agreed that the federal government is to blame for skyrocketing tuition costs, but said in the same breath that Washington will still continue to offer student aid – since 1978, the cost of college tuition in the U.S. has soared by 900 percent.

“I want to help our students, but I believe we will assist them the most by eventually transitioning student aid away from the inefficient and ineffective federal government and back to local governments and private market-based solutions — which simply work better,” said retired Texas Republican Congressman and three-time presidential candidate Ron Paul in a USA Today op-ed piece. “Getting the federal government out of the way will give us better educational opportunities at a better price.”

Student debt is stunting the growth of the economy. Student loans have increased by 275% over past decade. As the next generation graduates from college, they are plagued by insurmountable debt that places demands on their income, limiting their ability to spend their earnings in ways that stimulate the economy.

Here at Student Debt Relief we are able to get your student loans out of default with in 4-6 weeks through several government programs you may qualify for, this will allow you to file your taxes this year and receive a monthly payment that can go as low as $25. This will clear up your credit report and you will then be able to qualify for additional finical aid please give me a call 1-855-429-9577 http://www.wehelpstudentloan.org.

The public service loan forgiveness program will probably be repealed sometime in 2019 or 2020, no matter which party is in control of Washington. Any one expecting to get their loans forgiven with this program is fooling themselves. The forgiveness portions of the income based repayment options for student loans will also probably be repealed long before anyone can benefit, for the same reasons. Though if you are looking for cash to make their payments, try to apply to http://www.cashloansonlinefast.com/