Soaring consumer debt levels will likely trigger the next recession. In total, U.S. consumers hold just under $14 trillion in debt, which is the biggest in the nation’s history. And it is only ballooning.

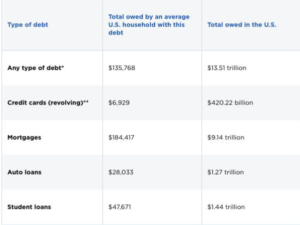

According to a new study by NerdWallet, the average American household carries about $7,000 in revolving credit card debt, up from $6,081 last year. Month-month credit card balances rose to $420 billion in 2018, which represents a 5% increase from last year.

Despite a booming economy, consumers are relying on debt to get by, mainly because expenses are rising faster than incomes. Analysts say that there are three primary contributors to the surging debt: medical care, food costs, and student loan forbearance.

Here’s a look at what Americans owe:

These are frightening numbers.

With rising interest rates, to service this debt is going to cost billions more.

Leave a Comment