By: Robert Murphy

Both fans and foes of the so-called Green New Deal (GND) agree that it is a wildly ambitious set of proposals, which—by design—will involve the federal government spending boatloads of money. In fact, the GND is so expensive that Rep. Ocasio-Cortez has cited the inflationary doctrine of Modern Monetary Theory (MMT) to deflect the issue; we don’t need to worry about the cost of the Green New Deal, so the argument goes, because the Federal Reserve can create an unlimited number of dollars.

Even so, more sober-minded policymakers, as well as the general public, should be aware of just how ludicrously expensive the GND really is. A recent analysis by the American Action Forum puts the initial 10-year cost at a staggering $93 trillion. Although the reader might understandably assume that this is an inflated figure designed to discredit the GND, it actually rests on a few conservative assumptions. The figure of $93 trillion is admittedly absurd, but that’s only because the planks of the GND are absurdly expensive. The American Action Forum estimate is entirely fair.

The Major Components of the Green New Deal

The American Action Forum is headed by Douglas Holtz-Eakin, who—among other positions—was the director of the Congressional Budget Office (CBO) from 2003 to 2005. One can of course disagree with his team’s analysis, but their approach to “budget scoring” the GND is entirely conventional in DC circles.

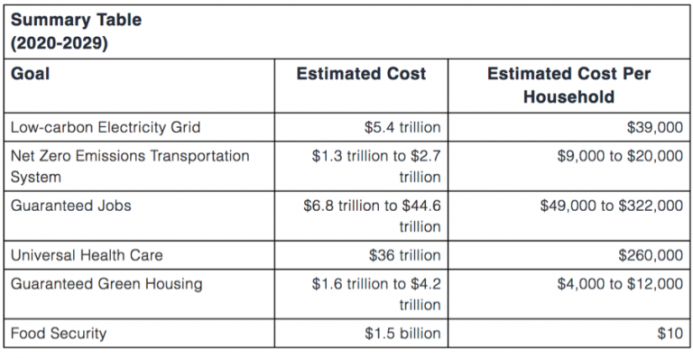

For their analysis, the AAF team focused on six major planks of the GND that they considered tractable for quantification. The table below summarized the various cost estimates for each of the six items:

Source: American Action Forum

Notice that there are many items listed in the GND documentation that are not included in the table above. This is one reason that I have called their cost estimate conservative.

Another important point is that the absurd $93 trillion figure is not driven by one particular modeling choice. On the contrary, five of the six components studied by the team have a (10-year) cost exceeding $1 trillion. So even if it turns out that, say, the AAF team is totally wrong on the cost of Universal Health Care and Guaranteed Green Housing, then the cost would still exceed $50 trillion for the first decade, because of the other components.

Elements of Green New Deal Redundant

The AAF analysis points out something that I haven’t seen others stress: Some of the components of the Green New Deal are oddly redundant. As the authors explain:

For example, a costly retrofitting of every structure in the United States seems considerably less environmentally beneficial once the electricity grid is completely transformed to use 100 percent clean energy than it would be if undertaken with today’s energy mix. Such a retrofit would have no impact on emissions. Similarly, the GND promises to ensure that every person has a guaranteed job, a family-sustaining rate of pay, and benefits such as paid leave and paid vacations. If everyone has good pay with good benefits, why is it simultaneously necessary to provide targeted programs for food, housing, and health care? Some of these objectives appear to be redundant. (American Action Forum, bold added.)

In my view, the particular observation I put in bold is especially poignant. It shows just how shallow the thinking of the Green New Deal proponents really is. What I think clearly happened here is this: It is standard in the “fight against climate change” to agitate for energy-efficient buildings, which have (for example) well-insulated windows to reduce heating and air conditioning expenses. In the context of our current grid, where most electricity comes from coal and natural gas, this makes sense.

At the same time, climate activists have been clamoring for subsidies, mandates, and taxes in order to force the grid to rely more heavily on wind and solar. Therefore, since (I claim) the Green New Deal is simply a wish list of standard progressive social goals, rather than an actual blueprint for fighting the technical problem of (alleged) human-caused harmful climate change, it shouldn’t surprise us that both of these long-standing goals—namely, refitting buildings and pushing the grid to zero emissions—are featured prominently in the Green New Deal.

Yet as the AAF authors explain in the block quotation above, this doesn’t really make any sense. If the electrical grid doesn’t emit any greenhouse gases, then there’s no reason to retrofit every building in America. You would think the proponents of the GND would be overjoyed to hear this, but I’m guessing they won’t drop their plans for trillions of dollars in construction work being shoveled to unions.

Explaining the Estimate of Converting the Grid

In the remainder of this article, I’ll run through two of the calculations by which the AAF team arrived at their enormous estimates. First, consider the move to a zero-emission grid. This is the opening of their analysis of this component:

We estimate that to transition to a power sector that has net zero emissions of greenhouse gases in 10 years would require a capital investment of $5.4 trillion by 2029. In addition, the annual operation, maintenance, and capital-recovery costs would be $387 billion. We consider this estimate to be conservative in two respects. First, we assume that a low-carbon electricity grid is feasible with only 4 hours of storage available for renewable resources; academic estimates have said a reliable grid requires 12 hours. Second, we assume no new construction of transmission assets is required, even though efficiently siting new renewable assets will require significant transmission infrastructure. (American Action Forum, endnotes omitted.)

In addition, their analysis is also (very) conservative because they “assume that states without nuclear moratoriums build approximately 50 percent of their needed capacity with nuclear power.” But as I explained in my earlier IER critique of the Green New Deal, they have clarified that their plan does not involve an expansion of nuclear.

Also, although the AAF analysis gives an estimate that electric bills will rise by 22 percent in the scenario they study, a glance at the original table shows that this cost to households—in the form of higher electricity prices—is not included in the headline estimates. In other words, when the quoted “cost” of $5.4 trillion is just capturing the out-of-pocket expenditure necessary to build the new plants to replace the capacity currently provided by coal- and natural gas-fired plants. The figure does not include the opportunity cost to the economy as a whole, from relying on less convenient forms of energy. Making energy more expensive for families and businesses “costs” a lot: not just conventionally in the form of foregone opportunities, but also in social discord owing to government-mandated energy price increases. The ongoing weekly riots in Paris initiated by opposition to a modest carbon tax illustrate the phenomenon.

Explaining the Job Guarantee Cost Estimate

In this final section I’ll explain the AAF estimate of the cost of the federal job guarantee. Here is the relevant table:

Source: American Action Forum

Here the calculations are pretty mechanical—and this is why they’re also very conservative, as I will eventually explain. The calculations assume that the federal government, as part of the Green New Deal, offers jobs paying at least $473 per week, and $625 per week on average.

Now then, if we first ask how many people would normally be unemployed according to the standard U-6 measure, and then we want to instead limit that unemployment rate to 1.5%, we come up with the figure of $547 billion in the year 2019.

Specifically, the AAF authors assume that the average outlay per job is $56,000, a figure derived from a pro-job guarantee study published by the Center on Budget and Policy Priorities. Then, using the number of unemployed (according to the U-6 measure, which includes those who are “part-time for economic reasons”) in January 2019, they calculate that a little under 9.8 million Americans would need to be given a federal job, in order to reduce the U-6 unemployment rate down to 1.5%. The cost thus works out to the $547 billion expenditure, shown in the first row of the table.

The second calculation includes not just the officially unemployed, and those who are working part-time for economic reasons (i.e. the U-6 measure), but also includes the fact that the Labor Force Participation Rate (LFPR) would presumably increase, if a federal job paying at least $473 per week were now on the table. Since more people would have come into the labor force, it presumably would cost the government more money to maintain the official U-6 unemployment rate at 1.5%, and hence the cost jumps to $598 billion in 2019, and so on.

In the next two lines, the study includes the consideration that many people who are currently working full-time might quit their current jobs, and try to receive the federally guaranteed jobs, which pay (to reiterate) at least $473 per week, and pay $625 on average. Naturally, if we assume that people with current jobs start switching over, the cost explodes, leading to the enormous estimates shown in the table.

Yet there is another consideration that the study’s authors haven’t included. As millions of people become employed by the federal government doing “busy work,” and yet getting paid an average of $625 per week, it will necessarily be the case that the living standards of everyone else—on average—go down.

For example, if a million people go from being unemployed to earning collectively $625 million per week, then they will naturally consume much more than they used to. But these million people are obviously not going to be producing $625 million in additional output, boosting total GDP by that same increment. If they could do that, then the federal government wouldn’t have needed to hire them; private companies would have done so.

So if these million people are now consuming much more than they used to, but their newly-offered labor (because before they were unemployed) isn’t itself producing the goods and services being purchased, then it must be the case that other people’s paychecks aren’t going as far as they used to. The specific way this outcome will manifest itself would depend on how the Green New Deal is financed, but it would probably be a combination of (a) the other workers having smaller after-tax incomes because taxes have gone way up to finance the Green New Deal, (b) interest rates have risen to finance the higher deficits, and (c) the prices of the goods they buy have gone up more than their paychecks, because of the extra inflation from the Fed needed to help finance the GND.

Yet in this environment, with the federal government offering a guaranteed job with a “floor” salary, more and more workers will quit their original jobs and take the federal one. Depending on the numbers, a vicious spiral could develop, in which more people flock to the guaranteed federal job, whose wages are ultimately paid for by the ever-shrinking remnant of workers in the genuine private sector. To use a biological metaphor, if a parasite grows too rapidly, it could end up killing the host and thus its own source of sustenance.1

Conclusion

The Green New Deal contains a wish list of progressive social and economic goals that come with a staggering price tag. A recent estimate from the American Action Forum puts the 10-year cost at an incredible $93 trillion. Yet as we have explained above, this estimate is conservative because it leaves out many practical considerations. It’s difficult to be precise, however, because the plan’s authors have been (deliberately?) vague on the details.

In reality, the Congress will not be so foolish as to attempt an undertaking so ludicrously expensive. Yet even if they implement a Green New Deal “lite,” the package would still add many trillions in government debt, while making energy and transportation more expensive for American households and businesses.

This was originally posted on Mises.org.

Leave a Comment