By: Andrew Moran

In the last couple of years, it looked like the major central banks around the world were on their way to monetary policy normalization after nearly a decade of unconventional tools. We were led to believe by the smartest men in the room that interest rates would gradually rise to historical norms, excessive money-printing would slow down, and so-called extraordinary measures would cease because the economy had apparently recovered. Instead, the central bankers are promising stimulus after several years of … stimulus.

It’s a mad, mad, mad, mad world after all. Everyone now needs a chocolate fudge sundae with whipped cream and a cherry on top a la Spencer Tracy.

Hit The Brakes, Pal

In the aftermath of the recession, central banks installed training wheels on the bicycle in the form of zero or near-zero interest rates. Years later, they incrementally took the training wheels off to allow governments and markets to make it on their own; in 2018, most central banks introduced at least one rate hike. Well, these institutions have seen economic performance minus the crutch, and the results have not been pretty. Economies are falling off their bikes, scraping their knees, and crying for their mommies. Like any good helicopter parent would do, central banks are swooping in and accommodating markets by hitting the pause button on rate normalization. In fact, for the first time in six years, not one central bank has pulled the trigger on a rate hike.

The Federal Reserve is anticipated to cut the funds rate at its next Federal Open Market Committee (FOMC) meeting from the current target range of 2.25% to 2.50% by at least a quarter-point. The European Central Bank (ECB) hinted that it is dipping into subzero territory in September. The Bank of England (BOE) is holding steady and has suggested it could lower rates in the event of a no-deal Brexit. The Bank of Canada (BOC) is not making a move on rates until after the fall federal election. The Bank of Japan (BOJ) has said that it is ready to reduce rates if the data supports it. The People’s Bank of China (PBOC) has already restarted its easing initiative.

Economic conditions in many of these markets are pitiful. The eurozone cannot muster 1% monthly growth, Beijing is experiencing its worst slowdown since the early 1990s, Canada is expanding at an anemic pace, Tokyo is inching closer to a recession, and London is contending with uncertainty over Brexit.

But why is the US on the list of economies reversing its normalization? If the economy were as strong as President Donald Trump and the primary data suggest, then it would be able to withstand 2.5% rates or higher. But the Fed is ostensibly heeding the advice of New York Fed Bank President John Williams who believes that it is better for central banks to “take preventative measures than to wait for disaster to unfold.”

According to recently revised growth forecasts by the International Monetary Fund (IMF), the global economy is set to grow 3.2% this year and 3.5% next year – both estimates are down 0.1% from its previous projections. The World Bank is even more bearish, prognosticating 2.6% and 2.7% for 2019 and 2020.

A Flood Of Cheap Money

There are only two things left to do for these institutions. The first is to return to the same policy tools that were utilized soon after the financial crisis. The second is to slip into negative territory. Neither is the most desirable option on the table, but that is what you can expect from these unelected, unaccountable, and unsound central bankers until the next crash.

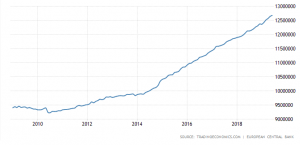

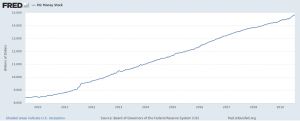

In the meantime, central banks will flood the market with cheap money to successfully bring interest rates down. The M2 and M3 money supply – measurements of the total value of dollars, euros, or yuan in an economy – numbers from around the world are eye-popping. The Fed and ECB alone have printed trillions of dollars and euros and funneled the money into the economy. This trend initiates the real possibility of sky-high price inflation, similar to what happened in the US during the 1970s and 1980s, prompting these entities to reverse course and raise rates to curb inflation.

Should the world order crash and inflation rear its ugly head simultaneously, it will be interesting to witness how the Fed, ECB, or BOC will react. They will be stuck in between a rock and a hard place – rate cuts or rate hikes.

Pull Up Your Pants – Do The Keynesian Dance

When the global economy appeared to return to normal, thanks to the unprecedented and eternal wisdom of apotheoses Ben Bernanke, Mario Draghi, Mark Carney, and the rest of the central bank stars, Keynesians celebrated like Joan Collins at happy hour.

They pointed and laughed at critics who thought there would be massive inflation and a crash that would be worse than the Great Recession. Trillions in newly created money, artificially-controlled interest rates at historic lows, billions in bailouts, and perpetually accommodative monetary policy – this was Keynesian economics on steroids, minus Paul Krugman’s space alien invasion.

Ah, money-printing: The cause of, and solution to, all of life’s problems.

So, was all this for naught? Did governments and consumers spend themselves into oblivion and take on debt they could not afford for a phony recovery? Are central banks setting themselves up for an even bigger financial disaster when the next downturn occurs? These are important questions to ask and answer, especially considering that they now have nothing left in their toolboxes after exhausting all conventional and unconventional policy tools following the 2008 meltdown.

Thanks! We hope you learned your lesson, central bankers. Never help anyone.

This was originally published on Liberty Nation.

Leave a Comment